The Scholarship That Teaches Investing

Real Money. Real Education.

WELCOME TO THE FINANCE LAB

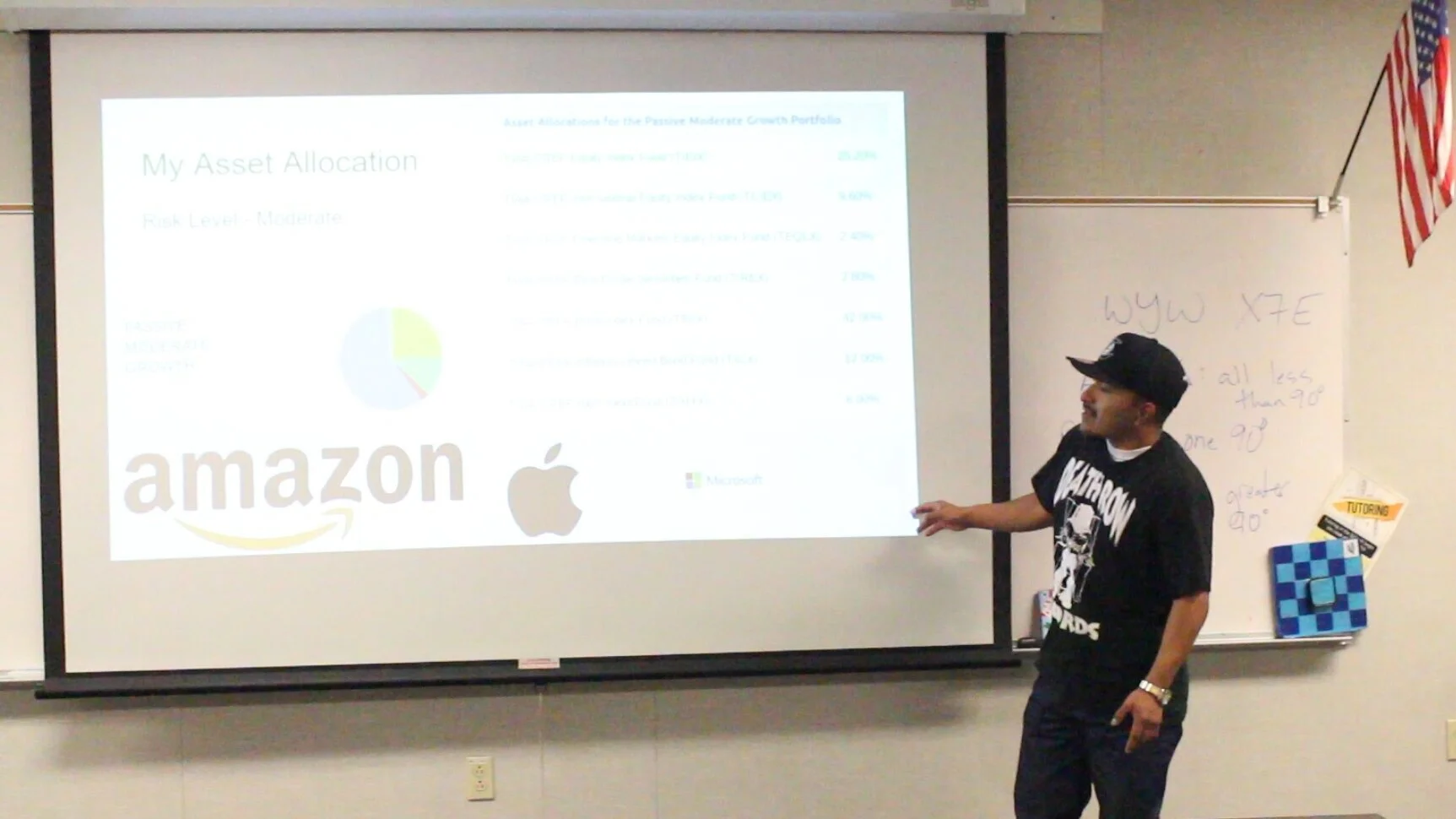

Free online curricula teach students about investing. We teach them investing by doing it. That's a fundamentally different philosophy — and it changes outcomes.

Real Money, Real Stakes

Our students invest actual dollars in real brokerage accounts. Not simulations. Not hypotheticals. The emotional weight of real money changes how students engage with every concept.

Learn, then Earn

Scholarship funds are disbursed in milestones tied to learning. Students earn their next $250 by demonstrating true understanding — creating accountability that a free course cannot replicate.

Authentic Audience

Students present their investment strategies to panels of real professionals. Knowing you'll defend your choices in public transforms how seriously you approach the work.

Designed for Access

Built specifically for underserved communities — with inclusive processes and a focus on first-generation wealth builders who won't typically get this education at home.

Years-Long Relationship

From spring application through the first two years of college, our scholars have ongoing mentorship and support. Learning sticks when it happens over time, not in a single afternoon.

College Transition Support

Financial literacy meets a critical moment: the transition to college. Students learn to invest while navigating the biggest financial decisions of their young lives.